Discover the Right Account tailored for You or Your Business.

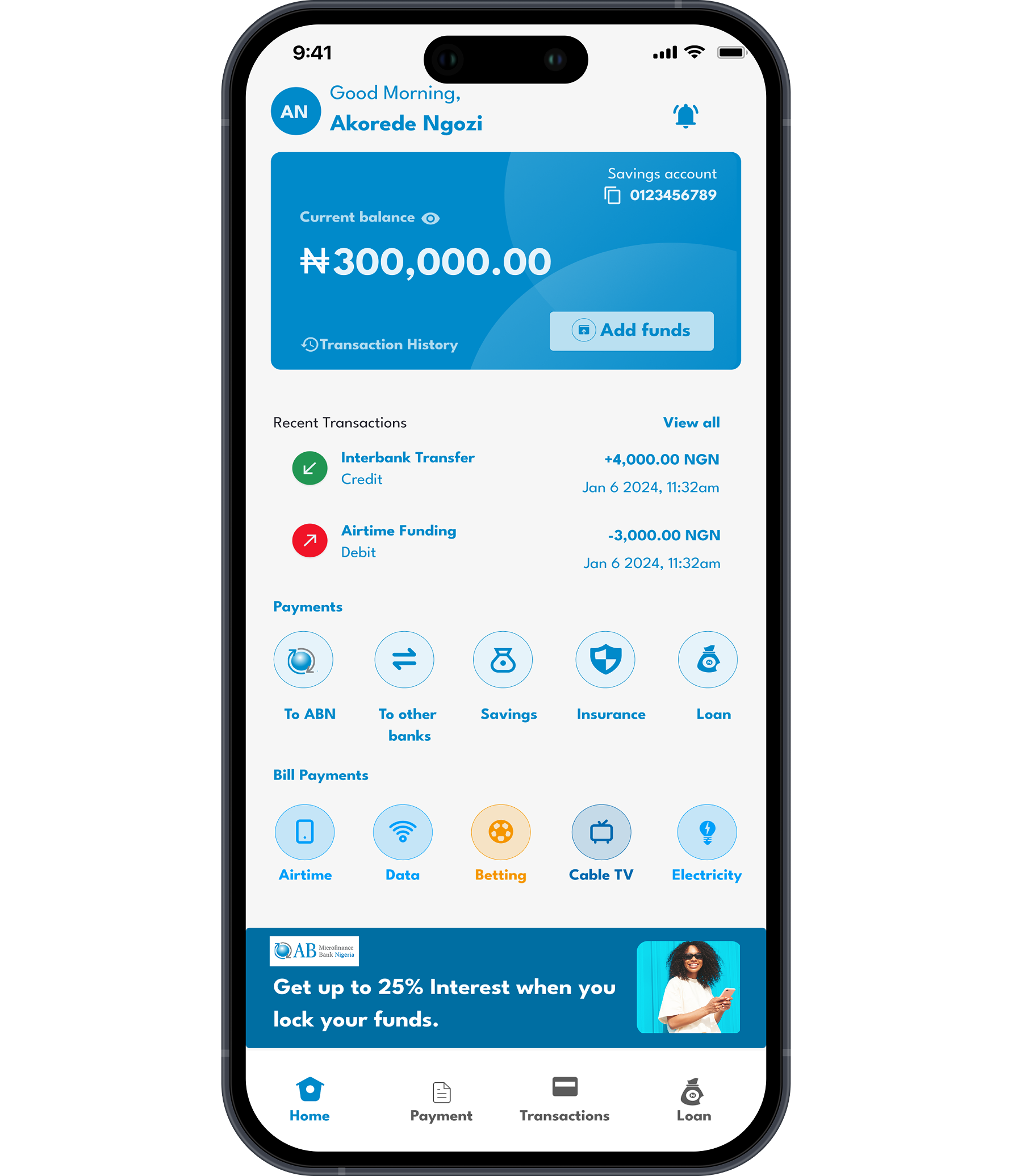

Savings Account

Whether you're saving for a goal or just getting started, we’re here to help you grow — one smart move at a time.

Current Account

Manage your money with ease—whether you're running a business, receiving your salary, or paying bills.

Fixed Deposit Account

Let your money work for you, invest with us and earn high returns on your deposit.