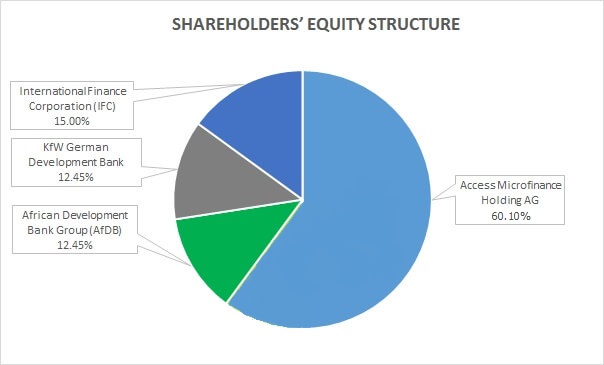

Shareholders

The Bank has an exceptional group of very strong international shareholders committed to the task of improving access to financial services in the country.

Our shareholders are Access Microfinance Holding AG of Germany, International Finance Corporation (member of the World Bank Group) in the USA, KfW – the German Development Bank and African Development Bank Group in Ivory Coast

AccessHolding is a strategic investor in the microfinance industry. It was established in 2006 by LFS Financial Systems with shareholding of 23.77%. Other shareholders are; CDC Group Plc (a UK government owned fund investing in developing and emerging economies) with a shareholding of 11.82%, EIB – European Investment Bank (the European Union’s financing institution) with shareholding of 11.82%, IFC – International Finance Corporation with shareholding of 14.88%, KfW Development Bank with shareholding of 12.71%, Omidyar Tufts Microfinance Fund (created by the founder of EBay) with shareholding of 11.21%, Multi Concept Fund Management with shareholding of 5.83%, responsibility SICAV with shareholding of 3.14%, Triodos Fair Share Fund (TFST) and Triodos Microfinance Fund(TMF) with shareholding of 2.40% respectively. AccessHolding invests in microfinance institutions and develops these investments through a combination of equity finance, holding services and management assistance, building a global network of AccessBanks with a common brand identity.

IFC, a member of the World Bank Group, creates opportunity for people to escape poverty and improve their lives. IFC fosters sustainable economic growth in developing countries by supporting private sector development, mobilizing private capital and providing advisory and risk mitigation services to businesses and governments. The corporation’s new investments totalled USD 14.5 billion in fiscal 2009, helping channel capital into developing countries during the financial crisis.

KfW Entwicklungsbank (KfW Development Bank): On behalf of the German Federal Government, KfW Entwicklungsbank finances investments and accompanying advisory services in developing and transition countries. Its aim is to build up and expand the social and economic infrastructure of the respective countries, and to advance sound financial systems while protecting resources and ensuring a healthy environment. KfW Entwicklungsbank is a leader in supporting responsible and sustainable microfinance and is involved in target group-oriented financial institutions around the world. It is part of KfW, which has a balance sheet total of EUR 442 billion (as of 31 December 2010). KfW is one of the five biggest banks in Germany and is AAA-rated by Moody’s, Standard & Poor’s and Fitch Ratings.

As of 31 December 2011, the African Development Bank’s authorized capital is subscribed to by 78 member countries made up of 53 independent African countries (regional members) and 25 non-African countries (non-regional members). The institution’s resources come from ordinary and special resources. Ordinary resources comprise: the subscribed shares of the authorized capital, a portion of which is subject to call in order to guarantee AfDB borrowing obligations;

- funds received in repayment of AfDB loans;

- funds raised through AfDB borrowings on international capital markets;

- income derived from AfDB loans; and

- other income received by the Bank, e.g. income from other investments.